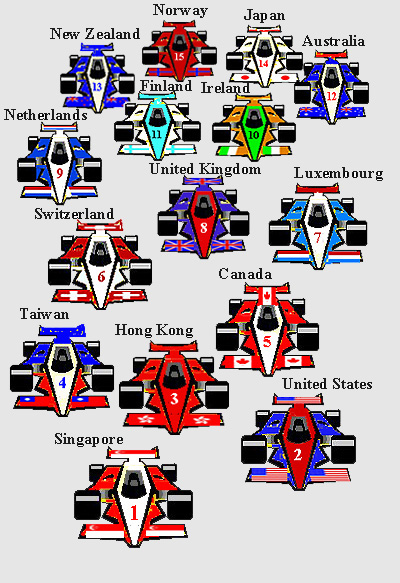

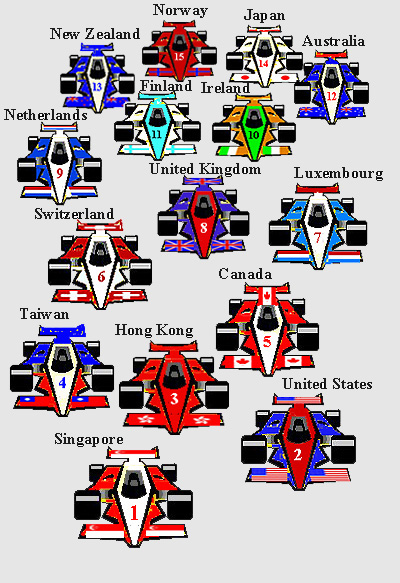

The Top 15 Countries Well Positioned For Growth

Source: WEF. The Global Competitiveness Report 1999

The WEF's Competitive Index is constructed to extrapolate a country's economic growth potential over a long time horizon. According to Harvard Professor Jeffrey D. Sachs, "Competitive countries are those that have the underlying economic conditions to achieve rapid economic growth for a number of years, taking into account their starting level of income. In general, our index is not designed to forecast short-run events such as financial panics, exchange rate shocks or changes in a country's export prices that may cause temporary booms or recessions. Instead, we hope that our index helps countries understand whether they have in place the conditions for rapid economic growth over the next decades." By focusing on the fundamentals and keeping an eye on the long term, the report avoids getting distracted by short lived cyclical fluctuations.

The broad categories of criteria analyzed by the WEF to construct the Competitive Index are openness, government, finance, infrastructure, technology, management, labor, and institutions. The methodology combines quantitative economic data with an Executive Opinion Survey of over 3,000 leading business executives from nearly all of the countries evaluated. The report is a monumental undertaking, and it has become more refined over the years.

Each category contains sub criteria which are combined to calculate the overall index and ranking for each country. Openness, for example, focuses on a country's tariffs and quotas, foreign exchange reserves, and exchange rate volatility. According to Professor Sachs, "The single economic policy variable that best distinguishes rich from poor countries is economic openness. Poorer countries have higher tariffs than richer ones. . . . Poor countries report higher hidden import barriers. Poor countries report more difficulties in getting foreign exchange for importing. Poor countries have very high charges for making international telephone calls. The internet is much slower and difficult to access in poor countries. In other words, if we combine all the ways a country can be economically isolated, it is still the case that one of the distinguishing features of less developed countries is greater economic isolation."

When taking into account all of the criteria used by the WEF to rank the countries, the ideal country well positioned for future economic growth and development would be an open economy with sufficient foreign exchange reserves to weather an irrational capital flight. It would have a stable government, streamlined bureaucracy, low taxes, and not too much debt. The country would not be plagued by corruption, violence, crime, or cronyism. The financial sector would be sound and solvent, credit would be readily available, and the central bank would be independent. Financial markets would be increasingly sophisticated. There would be plenty of telephones (cellular) and fax machines as well as an internet infrastructure and culture. The country would have plenty of scientists and engineers. Enrollments in well funded universities would be rising. Labor management disputes would be rare, and private investment (both domestic and foreign) would be increasing annually.

The ideal country would be like a well tuned race car getting ready for a big long distance race. It would be well designed and well constructed. It would have a good team of experts, a good pit crew, the right fuel mixture, and durable tires. It would be so well balanced that it would almost drive itself. According to the WEF's Global Competitiveness Report 1999, the top 15 countries shown in the picture below are well positioned like a good race car for global competitiveness in the decade ahead.

The Top 15 Countries Well Positioned For Growth

Source: WEF. The Global Competitiveness Report 1999

While the countries depicted in the metaphoric image above are

considered

to have excellent future growth potential, not all countries fare so

well

in the 1999 Report. Russia, Ukraine, Zimbabwe, Bulgaria, Bolivia,

Colombia, Ecuador, India, Brazil, and Venezuela all received an index

rating

exceeding -1. These countries are weak in nearly every rating

category.

|

|

1999 |

1999 |

1998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Iceland |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mauritius |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costa Rica |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Slovak Republic |

|

|

|

| El Salvador |

|

|

|

|

|

|

|

|

| Vietnam |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zimbabwe |

|

|

|

|

|

|

|

|

|

|

|

|

The World Economic Forum and Harvard University's Center for International Development will be releasing The Global Competitiveness Report 2000 later this year. It makes a difference to all peoples in the world how well countries perform in terms of economic growth and growth potential. It is important because when two or more countries grow and trade with each other, they all come out ahead. Well managed balanced growth and trade (taking into account environmental costs) are positive sum games that can make more people better off without making someone else worse off. No matter where a country places in the rankings, it would benefit from a better economic performance by all the other countries.

Recommended Link:

World Economic Forum: http://www.weforum.org