March

25, 2000 Oil and gas prices have been increasing this year, and

they

surged upward dramatically earlier this month. The NYMEX sweet

crude

oil price peaked at $34 per barrel on March 7, and the price is still

above

$30 at this writing. NYMEX wholesale unleaded gasoline

prices

went briefly above $1.00 per gallon. They have decreased somewhat

since then but are still above 90 cents. In some parts of the

United

States, retail prices for unleaded gasoline are above $2.00 per

gallon, setting record highs!

March

25, 2000 Oil and gas prices have been increasing this year, and

they

surged upward dramatically earlier this month. The NYMEX sweet

crude

oil price peaked at $34 per barrel on March 7, and the price is still

above

$30 at this writing. NYMEX wholesale unleaded gasoline

prices

went briefly above $1.00 per gallon. They have decreased somewhat

since then but are still above 90 cents. In some parts of the

United

States, retail prices for unleaded gasoline are above $2.00 per

gallon, setting record highs!

The recent price increases are attributed to the combination of

cutbacks

in oil production by the Organization of Petroleum Exporting Countries

(OPEC) and increased demand as the world economy continues its economic

recovery from recession in the late 1990s.

When the prices of oil and gasoline go up, the world takes notice --

especially the world's big oil and gas consumers. The United

States

alone accounts for 25.6% of annual world oil consumption. Western

Europe accounts for another 20.4%, and Japan consumes 7.5%. In

the

newly industrializing countries (NICs) such as Korea and Taiwan and in

many less developed countries (LDCs), oil consumption has been

increasing

as a per cent of their GDPs. In the early 1970s emerging

economies

only accounted for 29% of total world oil consumption. Now they

account

for 43%. When the price of oil goes up, oil producers earn more

petrodollars

while oil and gas consumers pay more for less.

--- NYMEX Futures Price for West

Texas Immediate (WTI) crude oil

--- Posted Price for Heavy San

Joaquin Valley (SJV) crude oil

--- Spread between the two crude

oil prices

Source: Image is the property of

Berry Petroleum Company and is reproduced here with permission.

The graph above shows that oil prices fell to very low levels early

in 1999 but have been increasing steadily since then. As the two

graphs below demonstrate, oil and gasoline prices naturally tend to

move

together because oil is the raw material that is distilled or "cracked"

under pressure into gasoline.

Source: Images are the property of Oil World.

They

are reproduced here with permission and through the courtesy of Oil

World.

Oil is the world's principal source of energy. It permeates

economic

activity in forestry, farming, mining, manufacturing, construction,

transportation,

and travel. Therefore, rising oil and gasoline prices have

the

potential to send an inflationary shock wave throughout the global

economy.

Many of us recall the oil shocks of 1973-74, 1979-80, and

1990.

In each of those instances economies around the world went into

recession

following the dramatic increases in the prices of oil and

gasoline.

More specifically, they experienced what is called stagflation -- the

combination of recession and inflation. The 1973-74 bout with

global

stagflation was particularly acute. Some experts are now warning

that the latest surge in oil and gas prices could cause another dose of

stagflation in the global economy later this year.

Does history repeat itself? Is it likely that the world will

experience

an acute case of stagflation in the months ahead? Well, the

answers

are "yes and no." Certain events like oil shocks do recur from

time

to time, but the prevailing economic conditions when they occur are

never

exactly the same. Some experts are predicting that the current

oil

shock is likely to be rather benign in the context of recent trends and

the current state of the global economy.

An article in the March 11 edition of The Economist magazine

(page 77) warns of the possibility of another nasty encounter with

global

stagflation. However, it also cites four "good reasons to think

that

the economic consequences of the jump in oil prices will be less severe

than they were in the 1970s": (1) The recent surge in oil prices comes

at a time when oil prices were at their lowest level in real

terms

(i.e., adjusted for inflation) since 1972. Even after the

latest

round of price increases, real oil prices are barely half their 1981

level

--[See Graph Below]. (2) Industrialized economies are much less

dependent

on oil than they used to be. Their consumption of oil expressed

as

a percentage of of GDP is just over half what it was in 1972.

Shifts

to other fuels, the decline in manufacturing, and changing consumer

behavior

over the past 25 years account for this decrease. (3) Attributing

this third point to J.P. Morgan economist Philip Suttle, The

Economist

notes that previous oil price hikes were associated with wars that

added

an element of uncertainty. This time oil production is being cut

back voluntarily by OPEC in the absence of a military encounter

-- [See Graph Below]. (4) Previous oil shocks took place when the

rich economies were already overheating. In contrast, only the

United

States economy appears overheated at this time, while Europe and

especially

Japan currently have excess capacity. All of these points lead to

the conclusion that the recent surge in oil prices have the potential

to

slow the global economy down with a smaller effect on inflation than in

the past. It would appear that most countries are more likely to

get a future dose of mild

deceleration instead of acute stagflation

in the next twelve months.

Source: Image is the property of WTRG Economics and is

reproduced here with permission and through the courtesy of WTRG

Economics.

********************

The Anatomy of Stagflation

Stagflation

-- a recession combined with higher prices -- originates at the micro

level.

When the price of oil and gasoline goes up, each consumer is having to

pay more which leaves less income to spend on other goods and services

such as food, clothing, housing, furniture, electronics, insurance,

personal

care, entertainment, and medical services. When the consumer cuts

back spending on these other items, the economy begins to recede. If

the inflationary effects of higher oil and gas prices are greater than

the deflationary effects of declining demand for other goods and

services,

then the economy experiences stagflation. The reason that the

inflationary effects tend to outweigh the deflationary effects is that

the demand for oil and gasoline is inelastic. That means

that

the per cent increase in oil and gas prices is greater than the per

cent

decrease in the quantity demanded. The consumer literally spends

more money to purchase the same amount or less. (Note: If the

demand

for oil and gasoline were relatively elastic, then the consumer

would spend less of their disposable income on oil and gasoline when

their

prices increased because they would cut back their consumption of oil

and

gasoline to a greater degree than the increase in prices.

However,

economic studies consistently indicate that the demand for oil and

gasoline

is highly

inelastic).

Stagflation

-- a recession combined with higher prices -- originates at the micro

level.

When the price of oil and gasoline goes up, each consumer is having to

pay more which leaves less income to spend on other goods and services

such as food, clothing, housing, furniture, electronics, insurance,

personal

care, entertainment, and medical services. When the consumer cuts

back spending on these other items, the economy begins to recede. If

the inflationary effects of higher oil and gas prices are greater than

the deflationary effects of declining demand for other goods and

services,

then the economy experiences stagflation. The reason that the

inflationary effects tend to outweigh the deflationary effects is that

the demand for oil and gasoline is inelastic. That means

that

the per cent increase in oil and gas prices is greater than the per

cent

decrease in the quantity demanded. The consumer literally spends

more money to purchase the same amount or less. (Note: If the

demand

for oil and gasoline were relatively elastic, then the consumer

would spend less of their disposable income on oil and gasoline when

their

prices increased because they would cut back their consumption of oil

and

gasoline to a greater degree than the increase in prices.

However,

economic studies consistently indicate that the demand for oil and

gasoline

is highly

inelastic).

Consider a typical consumer in the United States who spends about

$2.50

on motor fuel out of every $100.00 of disposable income, leaving $97.50

to spend on everything else. If we assume (for simplicity) that

the

demand for gasoline is perfectly inelastic, then an increase in the

price

of gasoline from $1.00 per gallon to $2.00 per gallon will force the

consumer

to spend $5.00 to buy the same amount of gasoline, leaving only $95.00

for everything else. Each consumer will cut back spending on

other

goods and services by $2.50 for every $100.00 of disposable income.

The phenomenon of each consumer spending more money for the same

amount

or less gasoline while cutting back consumption of other goods and

services,

combined with the fact that higher oil and gas prices are raising the

costs

of energy and power to producers of everything from transporting goods

by truck to lighting a baseball field at night, spreads throughout the

economic system. It soon begins to show up in the economy's

macroeconomic

performance measurements. In the absence of any other offsetting

effects, aggregate supply decreases and the macro economy drifts toward

stagflation. It is particularly disagreeable because real GDP

declines,

cyclical unemployment increases, and the general price level rises.

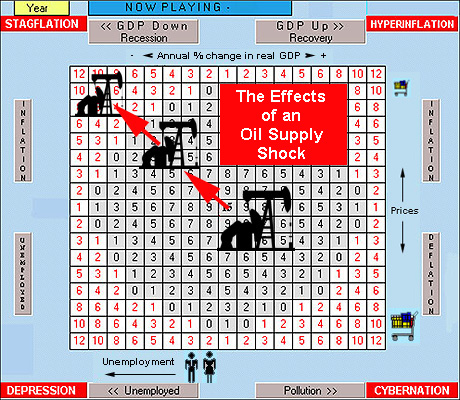

The picture below shows the playing field of The World Game

of

Economics. Stagflation

is depicted in the upper left corner. When an economy is in the

stagflation

corner, real GDP is falling and both unemployment and inflation are

rising.

The further into the corner an economy goes, the worse the stagflation

and the lower the score. (Red numbers are a negative score in the

game). When oil production is deliberately cut back to create a

shortage

as in the case of OPEC's recent action (or if other resources and raw

materials

are becoming increasingly scarce without offsetting technological

advances),

economies will drift toward the stagflation corner.

The extent to which an economy drifts toward the stagflation corner

due to an oil supply cutback depends on a number of factors: (1)

The higher the price of oil and gasoline goes relative to other prices,

the greater the adverse effects on an economy's GDP and inflation; (2)

The longer the duration of the price increase without offsetting

events,

the greater the impact; (3) The greater an economy's consumption of oil

and gasoline, especially as a per cent of its GDP, the more

severe

the stagflation will be for that country; (4) If an economy

already

has inflation or is in recession at the time of the oil shock, then the

oil and gas prices will exacerbate an already undesirable

situation.

It's likely that the effect on a country already in recession will be

less

on inflation and more on output and unemployment. (5) The higher the

concentration

of oil production, exports, refining, and distribution, the greater the

potential for inflationary effects of an oil shock on the world's

economies.

When we apply these generalizations to the current oil shock, we are

led to the conclusion that its effect will be remarkably different on

the

economies around the world. Were it not for the fact that oil

consumption

has declined to a relatively small per cent of its GDP, the United

States

economy would be the most vulnerable because of its sheer volume of oil

consumption and imports and the fact that its economy is already

operating

at full employment. It imports approximately 8.225 million

barrels

of oil per day and accounts for nearly one fourth of total world

imports.

However, it is sitting on 570 million barrels of government reserves,

which

the Clinton administration is considering releasing into the

market.

Japan, the world's second largest economy, is in a more precarious

position.

It imports all of its oil at about 4.584 million barrels per day, and

its

economy recorded negative growth in GDP in the 4th quarter of

1999.

The current increase in oil prices is likely to have much less impact

on

Japan's inflation rate than it will on dashing its hopes for economic

recovery.

Western Europe is likely to experience a little of both the "stag" and

"flation" in the term stagflation. Ironically, the most

vulnerable

economies and the ones that are likely to feel the dual adverse effects

of an oil shock are the developing countries in Asia and South America

that have just recently bounced back from recession. Oil

consumption

as a per cent of their GDPs has risen significantly in the past 25

years,

their economies are just beginning to boom again, and some of them are

already experiencing accelerating levels of inflation.

The previous analysis assumes that oil and gas prices stay at their

current levels. They may actually decline in the next few

months.

OPEC is not nearly as powerful as it was in the 1970s. [The

thirteen

members of OPEC are Algeria, Ecuador, Gabon, Indonesia, Iran, Iraq,

Kuwait,

Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, and

Venezuela].

These countries currently account for 60 per cent of world exports, but

only 40 per cent of world production. Externally, non OPEC

countries

like Mexico might increase their production levels and undermine OPEC's

attempt to curtail supply. Internally, OPEC has its own

problems.

If Venezuela, which controls about 11 per cent of OPEC's quotas, were

to

break ranks and increase production in an attempt to help its own

economy

recover from recession, then oil prices would go down. If the

United

Nations were to relax the sanctions against Iraq's oil exports, there

would

be further downward pressure on oil prices. Iraq currently

commands

about 8.4 per cent of OPEC's quota system. The main county to

watch

in OPEC is Saudi Arabia, which accounts for nearly one third of OPEC's

production. Negotiations are currently underway with Saudi Arabia

to, at the very least, maintain production and prices at their

current

levels and, preferably, to increase production and bring prices back

down

a little.

However, a very good normative and ethical case can be made on

behalf

of the OPEC countries that they are merely recouping the deterioration

in their terms of trade over the past twenty years and that it's

reasonable

for the rest of the world to accept the current oil production and

price

levels. Most prices for other goods and services have increased

much

faster than oil and gasoline over that time period. For that

reason

alone, one could understand OPEC's resistance to political pressures to

bring oil prices back down. And it's difficult to defend the

complaints

of a typical gas consumer in the relatively rich and industrialized

countries

when they are burning gasoline in their sport utility vehicles and big

engine autos on gridlocked freeways as if it were rain water.

That said, the industrialized economies are currently in a better

position

to countervail OPEC than they have been in earlier years.

In

the past, oil shock stagflation has eventually been tamed through

discretionary

policy actions and the long run effects of market forces. Even though

stagflation

poses a demand side policy dilemma (i.e. increases in government

spending

and lower interest rates cause more inflation while decreases in

government

spending and higher interest rates will create still more

unemployment),

it can be attacked on the supply side. Deregulation and increased

competitiveness in the oil exploration, production, and distribution

sectors

can bring prices down. Recent developments in technology have

made

it possible for oil producers to react more quickly and more

effectively

to higher oil prices; and higher oil prices encourage more exploration,

development, and the search for alternatives in the long run.

The recent surge in oil and gas prices has definitely caused the

world

to take notice. There has already been a re-distribution of

real income and wealth from oil consumers to oil producers. Some

would reasonably argue that it merely evens things out over the last

twenty

years. The degree to which this recent trend continues in the

months

ahead remains to be unveiled. However, in light of the global

economy's

contemporary macroeconomic situation, it's likely that oil and gas

prices

will soon stabilize somewhere near their current levels and remain

there

until the next shock; and it's doubtful that the oil shock of 2000 will

be considered one of the most eventful in world history. [Note:

An

important OPEC meeting scheduled for Monday, March 27 in Vienna,

Austria

may provide new insights into which direction oil prices are likely to

move in the months immediatley ahead].

Postscript: April

1,

2000 The meeting of OPEC Ministries earlier this week in Vienna

resulted

in a tentative agreement to restore previous cutbacks in oil production

and increase output by 1.7m barrels per day. Iran refused to sign

the agreement, but indicated that it would increase production.

The

price of oil has dropped to below $30 per barrel in reaction to these

developments.

OPEC oil ministers have indicated that they would like to see the

international

price of oil stabilize at somewhere between $23 to $26 per barrel.

Sources and recommended links:

The Economist Magazine

(March

11th - 17th, 2000)

Berry Petroleum Company:

www.bry.com

Oil World: www.oilworld.com

WTRG Economics: www.wtrg.com

Organization of Petroleum Exporting

Countries:

www.opec.org

U.S. Department of Energy. Energy

Information

Administration: www.eia.doe.gov

Return

to Home Page Return

to World Economics News

The World Game of Economics

(C)

1999 Ronald W. Schuelke All Rights Reserved

Stagflation

-- a recession combined with higher prices -- originates at the micro

level.

When the price of oil and gasoline goes up, each consumer is having to

pay more which leaves less income to spend on other goods and services

such as food, clothing, housing, furniture, electronics, insurance,

personal

care, entertainment, and medical services. When the consumer cuts

back spending on these other items, the economy begins to recede. If

the inflationary effects of higher oil and gas prices are greater than

the deflationary effects of declining demand for other goods and

services,

then the economy experiences stagflation. The reason that the

inflationary effects tend to outweigh the deflationary effects is that

the demand for oil and gasoline is inelastic. That means

that

the per cent increase in oil and gas prices is greater than the per

cent

decrease in the quantity demanded. The consumer literally spends

more money to purchase the same amount or less. (Note: If the

demand

for oil and gasoline were relatively elastic, then the consumer

would spend less of their disposable income on oil and gasoline when

their

prices increased because they would cut back their consumption of oil

and

gasoline to a greater degree than the increase in prices.

However,

economic studies consistently indicate that the demand for oil and

gasoline

is highly

inelastic).

Stagflation

-- a recession combined with higher prices -- originates at the micro

level.

When the price of oil and gasoline goes up, each consumer is having to

pay more which leaves less income to spend on other goods and services

such as food, clothing, housing, furniture, electronics, insurance,

personal

care, entertainment, and medical services. When the consumer cuts

back spending on these other items, the economy begins to recede. If

the inflationary effects of higher oil and gas prices are greater than

the deflationary effects of declining demand for other goods and

services,

then the economy experiences stagflation. The reason that the

inflationary effects tend to outweigh the deflationary effects is that

the demand for oil and gasoline is inelastic. That means

that

the per cent increase in oil and gas prices is greater than the per

cent

decrease in the quantity demanded. The consumer literally spends

more money to purchase the same amount or less. (Note: If the

demand

for oil and gasoline were relatively elastic, then the consumer

would spend less of their disposable income on oil and gasoline when

their

prices increased because they would cut back their consumption of oil

and

gasoline to a greater degree than the increase in prices.

However,

economic studies consistently indicate that the demand for oil and

gasoline

is highly

inelastic).